Biomass Pellets: Global Market Outlook, Production, Raw Materials, and Green Energy Opportunities.

Global Biomass Pellet Market Overview

The biomass pellet industry has grown rapidly worldwide, driven by the push for renewable energy and sustainable fuels. Global production of biomass pellets reached around 44 million tonnes in 2022, up nearly 150% since 2012ren21.netpellet.org. This growth is fueled by surging demand in power generation and heating sectors as pellets replace coal and other fossil fuels. In value terms, the market was estimated at $9.5 billion in 2023 and is projected to expand to $16.0 billion by 2033 (about 5.4% CAGR)alliedmarketresearch.com. Europe is the largest market, accounting for roughly half of global pellet output and consumptionpellet.org. The United States is the top producer (mostly for export), with Vietnam recently rising to second placeren21.net. Major consumers include the EU (for both power plants and heating) and Asian countries like Japan (for power generation)ren21.net. This global momentum reflects strong investor interest and policy support for biomass pellets as a clean energy commodity.

Global trends indicate biomass pellets are becoming a mainstream renewable fuel. Europe’s bioenergy use is substantial – solid biomass (mainly wood pellets) exceeded coal in Europe’s energy mix by 2015 and now trails only nuclear among individual energy sourcespellet.org. Regions such as North America and Asia are also seeing rapid growth in pellet production and consumptionpellet.org. Analysts project steady growth ahead as countries seek to meet climate targets, presenting opportunities for investors, energy companies, manufacturers, and even farmer-producer organizations interested in sustainable fuel supply chains. With strong market fundamentals, biomass pellets are poised to remain a key player in the global renewable energy transition.

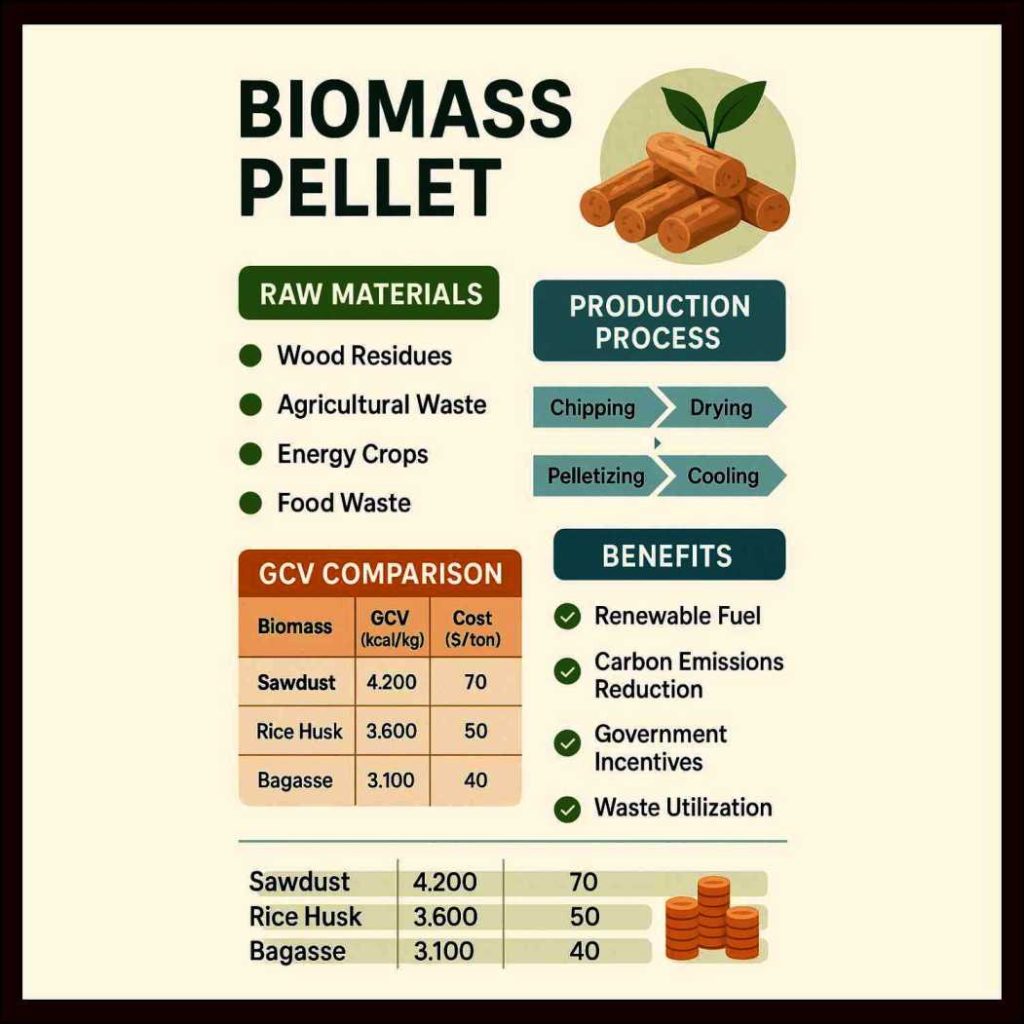

What Are Biomass Pellets? (Definition and Types)

Biomass pellets are a type of solid biofuel made by compressing organic materials into dense, uniformly sized cylinders. A typical fuel pellet is 6–8 mm in diameter and under 40 mm longkumarmetal.comextension.psu.edu, with larger presses producing “briquettes” if diameter exceeds ~25 mm. These pellets are formed by grinding biomass into fine particles and extruding them under high pressure through a die, causing the material to fuse into hard pellets without the need for significant additivesextension.psu.eduextension.psu.edu. The natural lignin in woody biomass often acts as a binder, and sometimes small amounts of organic binders are added for non-woody feedstocksextension.psu.edu.

High-quality biomass pellets are dry, hard, and durable, with low moisture and ash content. Premium-grade pellets generally have <1% ash content (standard grade <2%), moisture around 6–10%, and very little dust/fineskumarmetal.com. In shape and density, pellets are far more energy-dense than raw biomass – for example, wood pellets have an energy density around 11 GJ/m³, compared to only ~3 GJ/m³ for loose wood chipsalliedmarketresearch.com. This means pellets deliver much more heat per unit volume. They are also uniform in size and flow easily, allowing automated feeding into burners or gasifiers. In summary, biomass pellets convert bulky, low-density biomass into a compact, standardized fuel that is easier to handle, transport, and burn efficiently.

Types of Biomass Pellets

Biomass pellets can be made from a variety of organic feedstocks, generally classified into a few broad types:

- Wood Pellets: The most common type, made from forestry residues, sawdust, wood chips, or virgin lumber. Wood pellets typically have a high calorific value (GCV ~4200–4800 kcal/kg) and very low ash content (0.5–1.5%)servoday.in, making them excellent for clean combustion and high energy output. Softwood and hardwood residues are commonly used; kiln-dried sawdust produces very consistent, high-density pellets.

- Agricultural Residue Pellets: Made from crop residues like rice husk, wheat straw, corn stover, coconut husk, etc. These agro-pellets diversify the feedstock beyond wood. They tend to have lower energy content and higher ash than wood. For example, rice husk pellets have about 3000–3600 kcal/kg GCV but high ash (15–20% with silica, which can cause slagging)servoday.in. Wheat straw pellets offer ~3400–3800 kcal/kg with 5–8% ashservoday.in, while corn stalk/cob pellets are similar at ~3500–4000 kcal/kg and 4–6% ashservoday.in. These residues are abundant and cheap, but often need pretreatment or mixing with other materials to improve pellet quality.

- Energy Crop Pellets: Derived from plants grown specifically for fuel, such as miscanthus grass or Napier grass (elephant grass). These grasses can be harvested and pelletized; Napier grass pellets have ~3800–4200 kcal/kg GCV and 5–8% ashservoday.in, and miscanthus pellets about 4000–4500 kcal/kg GCV with ~3% ashservoday.in. Energy crops are attractive for their fast growth and renewability, though their pellet fuel properties vary and may require process optimization.

- Agro-Industrial Byproducts: Various processing residues can be pelletized, for example coconut shells, palm kernel shells, coffee husks, groundnut shells, etc. These often yield high-energy pellets – coconut shell pellets boast around 4800–5000 kcal/kg and low ash (2–4%)servoday.in, making them a very energy-dense fuel suited for industrial boilers. Groundnut shell or coffee husk pellets have moderate GCV (3500–4500 kcal/kg)servoday.in and are sometimes blended with other feedstocks to balance characteristics.

- Torrefied Pellets (Black Pellets): A more advanced type, made by torrefying biomass (a mild pre-carbonization at ~250–300°C in low oxygen) before pelleting. Torrefied pellets are dark, water-resistant, and have even higher energy content (typically 5000–6000 kcal/kg GCV)servoday.in. They mimic coal’s handling properties and are ideal for co-firing in coal plants. However, torrefaction adds cost, and these pellets are still emerging in the market.

Table 1: Common Biomass Pellet Feedstocks and Their Properties

| Feedstock | Gross Calorific Value (GCV) | Ash Content | Notes |

|---|---|---|---|

| Wood residues (sawdust, etc) | 4200–4800 kcal/kgservoday.in | 0.5–1.5%servoday.in | Excellent fuel; low ash, high efficiency |

| Rice husk (agri-residue) | 3000–3600 kcal/kgservoday.in | 15–20%servoday.in | Very abundant; high silica, causes clinkerservoday.in |

| Wheat straw (agri-residue) | 3400–3800 kcal/kgservoday.in | 5–8%servoday.in | Easy to pelletize; moderate ash |

| Corn stalks & cobs | 3500–4000 kcal/kgservoday.in | 4–6%servoday.in | Often mixed with other feedstocks |

| Napier grass (energy crop) | 3800–4200 kcal/kgservoday.in | 5–8%servoday.in | Fast-growing; good for co-firing |

| Miscanthus (energy crop) | 4000–4500 kcal/kgservoday.in | ~3%servoday.in | Perennial grass; low inputs needed |

| Coconut shell (byproduct) | 4800–5000 kcal/kgservoday.in | 2–4%servoday.in | Very high energy; dense industrial pellet |

| Coffee husk / Nut shells | ~3500–4500 kcal/kgservoday.in | varies (moderate) | Often blended to improve pellet quality |

| Torrefied biomass | 5000–6000 kcal/kgservoday.in | <5% (typically) | Carbonized “black pellets” for power use |

(Sources: typical values from industry dataservoday.inservoday.in)

As shown above, different raw materials yield pellets with varying performance. Wood-based pellets generally have the best fuel qualities (high heating value, low ash). Agricultural biomass can be pelletized as well – offering farmers a use for residues – but may require equipment adjustments (due to higher ash or silica content) and often suits larger boilers or specialized “biomass” stoves rather than small pellet stovesextension.psu.edu. Blending multiple feedstocks is also common to balance properties (e.g. mixing straw with sawdust to improve binding)extension.psu.edu. Ultimately, abundant local materials – whether sawmill waste, crop stalks, or palm shells – can be turned into standardized pellets, enabling a circular economy approach to waste utilization and rural income.

Biomass Pellet Production Process (Flow and Equipment)

Producing biomass pellets involves a series of steps to transform raw biomass into dense, dry fuel pellets. A typical pellet production process includes: feedstock preparation, size reduction, drying, pelletizing, cooling, and packingextension.psu.eduextension.psu.edu. Each step requires the right equipment and control to ensure consistent pellet quality. Below is a breakdown of the process flow:

Figure: Simplified process flow for biomass pellet manufacturing, showing key equipment steps from grinding to final bagging.extension.psu.eduextension.psu.edu

- Feedstock Sourcing and Preparation: Raw material (wood chips, shavings, straw, etc.) must be screened for debris and sometimes pre-processed. Large woody pieces may go through a chipper first to produce smaller chunksextension.psu.edu. Consistent feedstock quality (in terms of type, particle size, and moisture) is crucial. The feedstock choice depends on availability and desired pellet specskumarmetal.com; moisture content is typically reduced to about 10–15% before pelletingkumarmetal.com.

- Grinding (Size Reduction): The biomass is then ground into a fine powder. A hammer mill or similar grinder pulverizes the material to a particle size of ≤3 mm for standard pellet millsextension.psu.edu. If using coarse or dense biomass (like wood logs), a two-stage size reduction is common: first a chipper, then a hammer millextension.psu.edu. Fine, uniform particle size ensures the material can be densely packed and extruded through the pellet die.

- Drying: Proper moisture content is critical. Dryers (rotary drum dryers, belt dryers, etc.) are used to reduce biomass moisture to the optimal range (often around 10–12% for wood)kumarmetal.comextension.psu.edu. This may involve blowing hot air through the particles or using an oven. Many large pellet plants reuse biomass waste (bark, etc.) as a heat source for dryingextension.psu.edu. It’s important not to over-dry – a bit of moisture (say, ~10%) helps lignin plasticize and bind the pellets. Conversely, too much moisture will cause steam and disintegration of pellets. Operators often inject a little steam or water if the feedstock is too dryextension.psu.edu, to improve pellet formation.

- Pelletizing (Extrusion): The heart of the process is the pellet mill, where ground, dried feedstock is fed into a pelletizer. Inside, a roller presses the biomass through holes in a heavy steel die under high pressure and temperatureextension.psu.edu. As the material is forced through the die, it heats up due to friction (~100°C or more) and the biomass particles fuse into a solid cylinder (pellet)extension.psu.eduextension.psu.edu. Knives at the die face cut the emerging strands to the desired pellet length (typically 1–3 cm). This process is essentially extrusion – similar to a pasta maker, but with much higher force. Lignin (a natural polymer in biomass) softens with heat and acts as a glue, especially in wood, creating durable pelletsextension.psu.edu. For herbaceous or low-lignin materials, sometimes a binder (like starch or molasses, or a bit of sawdust) is added to help form strong pelletsextension.psu.edu. Proper die configuration and roller speed are important to avoid issues like “washthrough” (where material falls through without pelleting) or die pluggingkumarmetal.comkumarmetal.com. Modern pellet mills come in various sizes, from small 100 kg/hour units to large industrial presses outputting several tons/hour.

- Cooling: Freshly extruded pellets are hot (~120–150°C) and soft, and contain residual moisture and volatile compounds. They must be cooled and dried to harden. Pellets are typically spread in a cooling bin or conveyor where ambient or forced air is drawn through themextension.psu.edu. Within a few minutes of cooling, pellets release moisture and reach equilibrium at ~8–10% moisture contentextension.psu.edu. Cooling is vital for pellet durability – it prevents them from crumbling or growing mold in storage. The pellets also harden as lignin re-solidifies, locking the particles together.

- Sieving & Packaging: After cooling, pellets pass through a vibrating screen or sieve to remove any fines (loose sawdust) and broken pieces, which can be recycled back into the process. The finished pellets are then ready for use or sale. They may be conveyed into storage silos or bagging machines. Pellets are commonly sold in 15–20 kg plastic bags for retail (easy handling for home users)extension.psu.edu, or loaded in bulk into silos, big bags, or tanker trucks for large customers. Proper labeling is done to indicate pellet grade, source, and energy contentextension.psu.edu.

Throughout these steps, maintaining efficiency and quality is important. Pellet production is energy-intensive – grinding motors, large dryers, and pellet presses consume significant power. A rule of thumb is that about 50–100 kW of electrical power is required per ton/hour of pellet output capacityextension.psu.edu. Dryers also require heat energy, which many plants supply by burning a fraction of the biomass feedstockextension.psu.edu. Modern plants therefore integrate CHP systems or use burner systems to minimize external energy use. Automation is often used to control feed rates, temperatures, and pellet mill parameters to ensure consistent product quality.

Overall, the pellet production process adds value to raw biomass by densifying it into a high-energy fuel. By following standardized process steps and using the right equipment (chippers, hammer mills, dryers, pelletizers, coolers, etc.), manufacturers can produce pellets that meet international quality standards (such as ENplus or PFI standards). This standardized production also enables biomass pellets to be traded globally as a commodity fuel.

Cost Breakdown for Setting Up a Biomass Pellet Plant (CAPEX & OPEX)

Like any manufacturing venture, establishing a biomass pellet plant requires upfront capital investment (CAPEX) and incurs ongoing operating expenses (OPEX). Costs can vary widely depending on plant scale, automation level, and local factors, but general estimates and breakdowns are available to guide investors.

Capital Expenditure (CAPEX): The capital cost of a pellet production facility includes procuring pelletizing equipment, constructing the plant, and installing necessary utilities. A useful rule-of-thumb is to budget roughly $70,000 to $250,000 per ton-per-hour of production capacityextension.psu.edu. This wide range reflects different scales and equipment quality – smaller plants might achieve the lower end, whereas larger, high-grade installations trend to the higher end per unit of capacity. For example, a 1 ton/hour (~8,000 tons/year) plant might cost on the order of $0.1–0.25 million, while a 5 ton/hour plant could require a few million dollars. Approximately half of the capital cost is for the pellet mill itself, and the rest for supporting equipment (grinders, dryers, cooler, conveyors, buildings)extension.psu.edu. Turnkey industrial pellet lines (for large-scale wood pellet production) can indeed run into the millions; one study for a European plant cited pelletizing equipment costs around $3–4 million and around $2 million for site infrastructure like storage and loading facilitiesbestpelletplant.com. Investors should plan for sufficient CAPEX not only for equipment but also for site development, permitting, electrical and heat systems, and contingency for scale-up. Choosing reliable equipment suppliers and ensuring availability of spare parts is crucial – cheaper machinery may save upfront costs but lead to higher downtime or inferior pellet qualityextension.psu.edu.

Operating Expenses (OPEX): The ongoing cost to produce pellets includes raw material procurement, labor, energy, maintenance, and transportation (if distributing product). Feedstock cost is often the single largest component, especially if the biomass is purchased (e.g. wood chips or agricultural residues market price). After feedstock, major costs are electricity (running motors, dryers, etc.), labor (operators, supervision), and maintenance of machinery. To illustrate, one analysis (Deloitte, EU context) estimated total operating cost around $125 per ton of pelletsbestpelletplant.com. Within that, approximately $10/ton for labor and $10/ton for electric power were noted, plus about $5/ton each for routine maintenance and periodic repairs, and a few dollars for logistics (in-plant or local transport)bestpelletplant.com. The remainder (roughly $90/ton in this case) would largely be feedstock cost, which can vary greatly – some plants source residues at very low cost or even get tipping fees for waste, whereas others must pay market rates for wood fiber.

Maintenance includes wear-part replacement; notably, pellet mill dies and rollers wear out and must be periodically replaced (a typical die might last ~1,000–1,500 hours of operation)extension.psu.edu. Spare dies, grease, and other parts add to OPEX. Dryers and grinders also need upkeep due to handling abrasive materials. Labor costs depend on automation – highly automated plants can be monitored by a few staff, whereas simpler setups need more hands-on labor for feeding and bagging. Energy costs can be moderated by using biomass itself for drying heat (many plants burn bark or husk to fuel the dryer)extension.psu.edu, though electrical needs remain significant.

In summary, a biomass pellet plant’s profitability hinges on managing these costs: obtaining cheap (but sustainable) feedstock, maintaining efficient energy use, and keeping the operation streamlined. Table 2 below summarizes an indicative breakdown of pellet production costs per ton:

Table 2: Indicative Operating Cost Breakdown per Ton of Wood Pellets (Example)

| Cost Component | Approx. Cost (USD per ton) | Notes |

|---|---|---|

| Feedstock (raw biomass) | $70 – $90 | Can vary widely; often 50–70% of total cost |

| Labor | ~$10 | Assuming moderate automationbestpelletplant.com |

| Electricity | ~$10 | Power for mill, motorsbestpelletplant.com |

| Maintenance & Spares | ~$5 | Routine maintenance of equipmentbestpelletplant.com |

| Die/Parts Replacement | ~$5 | Major repairs, die replacement (averaged)bestpelletplant.com |

| Local Transport/Handling | ~$2–$5 | Internal logistics, loadoutbestpelletplant.com |

| Total OPEX | ~$100 – $130 | per ton produced (feedstock-dependent) |

(Source: Industry estimatesbestpelletplant.com; feedstock cost varies)

Capital costs can be significant, but numerous incentives and financing options may be available (see policy section). Many pellet ventures start at a modest scale and then expand capacity as supply and markets grow. Investors should perform detailed feasibility studies, but broadly the pellet business can be economically attractive, especially where low-cost biomass is available and there is strong demand (e.g. export contracts or local power plant offtake). The cost of production for well-run plants often falls in the range of $80–$120 per ton, while market prices for wood pellets in recent years have been higher (depending on region, often $150–200+ per ton, with spikes during energy shortages). This margin potential underscores why biomass pellet production has drawn interest from both commercial manufacturers and farmer-producer companies looking to valorize agricultural waste.

Comparison of Raw Materials and Pellet Performance

Not all pellets are created equal – the choice of feedstock greatly influences pellet fuel performance (calorific value, ash content, handling characteristics) and thus suitability for various applications. Below are some key comparison points across different pellet types:

- Energy Content (GCV): Wood-based pellets generally have the highest energy content, in the range of 16–20 MJ/kg (approximately 4,000–4,800 kcal/kg)servoday.inextension.psu.edu. Agricultural residue pellets are typically lower: for instance, wheat straw pellets ~16 MJ/kg and rice straw ~13–15 MJ/kgextension.psu.edu. Some residues like coconut shell or palm kernel pellets can approach wood in energy (~18–20 MJ/kg) due to their high lignin. Torrefied pellets can exceed 20 MJ/kg, rivaling some coals. Higher calorific value means more heat output per kilogram of fuel – important for both industrial and residential users looking to maximize energy per delivery.

- Moisture and Density: Quality pellets have low moisture (<10%). Wood pellets and many others, once cooled, reach around 6–8% moistureextension.psu.edu. This contributes to a high bulk density (~600–700 kg/m³ for wood pellets)extension.psu.edu, which is much denser than raw biomass (e.g. straw bales might be 150 kg/m³). Denser pellets reduce transport and storage costs. Grassy pellets (miscanthus, etc.) might be slightly less dense than wood pellets due to different fiber properties, but still far denser than their raw form.

- Ash Content: This is a critical factor for end-users. Wood pellets from clean sawdust have ash content well below 1%kumarmetal.com, meaning they burn very cleanly with little residue – ideal for small stoves or boilers with limited ash handling. Agricultural pellets often have higher ash: for example, straw pellets can have 5–7% ashextension.psu.edu, and rice husk can be >15% ash (with high silica)servoday.in. High-ash pellets require more frequent ash removal and can cause slagging (clinker formation) in burnersservoday.in. Thus, agro-pellets are more suitable for large boilers or purpose-built biomass furnaces that can manage ash. Blending feedstocks can help – e.g., mixing some wood or husk with straw to reduce overall ash percentage.

- Emissions and Clinker Formation: Pellets differ in their mineral content – some grasses contain alkali metals (potassium, chlorine) that can lead to fouling in burners. Wood pellets have low levels of such elements (especially if bark content is low), so they tend to burn without excessive depositskumarmetal.com. Pellets from cereal straws often need boilers with de-ashing systems and careful temperature control to avoid clinkers. Pellet standards (ENplus, PFI) set limits on ash and chloride content to ensure performance; e.g., chloride <300 ppm and fines <0.5% in premium pelletskumarmetal.com. Always, the end-use application dictates what pellet spec is acceptable – residential pellet stoves typically require premium wood pellets, while a large coal co-firing plant can consume lower-grade agro-pellets.

- Durability: Good pellets should resist crumbling. Durability is influenced by feedstock (wood’s lignin helps), process (pressure, moisture), and any binders. Wood and coconut shell pellets are usually very durable (≥97% durability index). Some grassy pellets can be more brittle unless optimally processed (smaller particle size, slight moisture addition, etc.). Torrefied pellets are hydrophobic (water-resistant) and very stable in storage, giving them an edge for long-distance transport and outdoor storage, whereas conventional pellets must be kept dry to avoid disintegration.

In practice, producers select feedstocks based on local availability and target market. In regions with sawmills, wood residues are a no-brainer for pelletizing. In farming regions with surplus straw or husks, agro-pellets make sense, often supplying nearby industries or power plants. End-users also choose pellet types according to needs: homeowners prefer low-ash, high-energy pellets (usually wood); power utilities might use a mix (some have experimented with agro-pellets for co-firing to utilize agricultural waste). Table 1 above and the discussion here illustrate that while all pellets serve as renewable fuel, their performance varies – and thus comparison and quality testing are important parts of pellet project development.

Environmental Benefits of Biomass Pellets (Carbon Reduction & More)

Biomass pellets are touted as a carbon-neutral or low-carbon fuel, and their use can bring significant environmental benefits when sourced and utilized sustainably. Here are key environmental advantages:

- Reduced Greenhouse Gas Emissions: When pellets are made from biomass residues or sustainably harvested wood, the CO₂ released during combustion is roughly equivalent to the CO₂ absorbed during the plants’ growth, resulting in a net-zero carbon cycle (apart from minor fossil inputs in processing/transport). In fact, burning biomass pellets can emit ~80% less net CO₂ than burning coal for the same energy outputalliedmarketresearch.com. Power generation from wood pellets typically shows carbon savings of 70–85% compared to coal on a lifecycle basis, according to studies, considering that regrowth sequesters carbonalliedmarketresearch.com. This makes pellets an attractive option for countries aiming to decarbonize energy. It should be noted that these carbon benefits assume sustainable forestry/agriculture practices – avoiding deforestation and ensuring regrowth is key to maintaining the carbon neutrality of biomass.

- Lower Air Pollutants: Compared to coal and oil, biomass pellets contain minimal sulfur and chlorinealliedmarketresearch.com, which means far lower SO₂ and HCl emissions – reducing acid rain and corrosion issues. Pellets also have low nitrogen content, resulting in less NOx formation than many coals. Modern pellet stoves and boilers burn very cleanly, emitting a fraction of the particulate matter that a traditional wood fire or coal fire would. For example, pellet combustion in certified appliances can cut particulate emissions massively, improving air quality (important in residential heating contexts). Pellets release fewer heavy metals and toxic pollutants as well, since they are made from clean biomass (no mercury as found in coal, for instance).

- Efficient and Complete Combustion: The uniform size and dryness of pellets lead to more complete combustion, meaning higher efficiency and fewer unburnt hydrocarbons or smoke. This improves overall environmental performance. A pound of pellets produces substantially more useful energy (at higher efficiency) than a pound of cordwood burned in a fireplace, for instance, so to deliver the same heat you burn less biomass and generate less pollution.

- Waste Reduction & Energy from Residues: Biomass pelletization can consume vast quantities of residual biomass that might otherwise rot or be openly burned. In agricultural regions, pellet plants offer a solution to crop residue burning – a major source of air pollution and carbon emissions in places like India. By turning rice straw, corn stover, and other residues into pellets, farmers get an economic use for waste and open-field burning is avoidedkumarmetal.com. This not only cuts smoke and particulates, but also avoids uncontrolled carbon release. In forestry, sawdust and bark that used to end up in landfills or be burned as waste are now used to make pellets, diverting waste streams into renewable energykumarmetal.com.

- Sustainable Land Management: When done responsibly, the pellet industry can incentivize better forest and farm management. Demand for wood pellets has encouraged practices like forestry thinnings (removing low-grade wood that improves forest health) and utilizing treetops and branches that were left in the forest. It can provide additional income for landowners, making sustainable forestry economically viable and preventing land from being converted to non-forest uses. In farming communities, collecting residues for pellets can reduce residue buildup and pest issues, while providing extra revenue.

- Carbon Neutral Heating Option: For residential and commercial heating, pellets offer a path to replace heating oil, LPG, or coal with a renewable fuel. Countries in Europe have calculated significant CO₂ reductions in the heating sector by switching tens of thousands of homes to pellet boilers. Modern pellet appliances also often include automatic feed and oxygen sensors to optimize combustion, further minimizing emissions and maximizing efficiency.

It’s important to acknowledge that sustainability criteria are essential to ensure these environmental benefits. Harvesting biomass must not result in forest degradation or excessive fertilizer use (for energy crops) that could negate carbon gains. Leading pellet markets like the EU have implemented sustainability standards (e.g. requiring replanting of forests, limiting raw material from high-carbon-stock land, etc.)ren21.net. When these guidelines are followed, biomass pellets stand out as a truly renewable, low-carbon energy source. In short, biomass pellets enable us to tap into solar energy stored by plants, displacing fossil fuels and supporting a circular carbon economy where today’s plant growth becomes tomorrow’s energy without adding new CO₂ to the atmosphere.

Additionally, using pellets supports local environmental quality. Replacing coal with pellets in power plants greatly cuts emissions of sulfur oxides, mercury, and particulates. Using pellets in cooking and heating (instead of dung or raw wood) improves indoor air quality and public health, a benefit recognized in many developing regions. Overall, biomass pellets, when sourced responsibly, offer significant carbon emissions reduction and pollution mitigation, contributing to cleaner air and climate change goals.

Government Policies, Incentives, and Subsidies Globally

Government policies around the world have been pivotal in spurring the biomass pellet sector. Many countries include biomass energy in their renewable energy strategies, offering various incentives – from direct subsidies and tax credits to renewable energy mandates – that encourage pellet production and use. Below is an overview of key policy environments in major regions:

European Union (EU)

The EU has been a leader in biomass pellet utilization, primarily driven by climate targets and renewable energy directives. Under the EU Renewable Energy Directive (RED) framework, biomass is classified as a renewable energy source, enabling member states to count pellet-based power and heat toward their targets. The latest revision, RED III, has set an EU-wide goal of at least 42.5% renewable energy by 2030ren21.net, and biomass (including pellets) is expected to play a role in meeting this. While supporting biomass, the EU is also strengthening sustainability criteria for solid biofuels – ensuring that wood pellets, for example, come from sustainably managed forests and that lifecycle greenhouse gas savings are significantren21.net.

Many EU countries have national incentives for pellet heating and power. For instance, governments provided an estimated €16 billion in subsidies for biomass energy in 2020 across the EU, reflecting strong support in renewable heating and power sectorsfern.org. These subsidies come in forms like feed-in tariffs or premiums for biomass electricity, capital grants for biomass boilers, and tax incentives for renewable heat. Renewable heat obligations in countries like the UK, Italy, and others have spurred pellet boiler adoption. Programs in Austria, Germany, France, etc., offer homeowners rebates or low-interest loans to install pellet furnaces, recognizing their lower carbon footprint. On the utility scale, green certificates and carbon pricing (EU ETS) effectively reward biomass power: utilities co-firing pellets avoid purchasing CO₂ allowances since biomass is carbon-neutral under the rules, an implicit subsidy valued at about €12 billion in avoided costs in 2020fern.org.

However, EU policy is evolving. There have been debates on phasing down subsidies for primary woody biomass (to ensure highest-value wood isn’t burned for energy if avoidable)knowledge.energyinst.org. Some proposals aim to gradually exclude certain pellet fuels from financial support by 2026, focusing support more on waste-residue biomass. Nevertheless, the final REDIII agreement in 2023 maintained that woody biomass will count 100% as renewable and remain zero-rated for carbon accountingir.envivabiomass.com, which was welcomed by industry as regulatory certainty. The EU is implementing stricter voluntary certification schemes and requiring that biomass fuels used in large installations meet sustainability criteria (e.g. forest regeneration, soil quality, biodiversity safeguards)energy.ec.europa.eu.

In summary, the EU’s policy stance has strongly favored biomass pellets as part of the clean energy mix, through a combination of mandates and incentives. European demand (for power stations and heating markets) has been a major driver for the global pellet trade – for example, Europe imports millions of tons of pellets annually from North America. Policies like carbon caps and renewable targets are likely to keep the EU as a key market, though with increasing emphasis on sustainability and efficient use of biomass.

United States

The United States is the world’s largest wood pellet producer, but much of the industry has been export-oriented (supplying Europe). Domestically, policies have been somewhat less centralized, but there are still important incentives and developments:

- Renewable Energy Targets and Credits: The U.S. does not have a federal renewable heat or power mandate, but many states have Renewable Portfolio Standards (RPS) that include biomass. Utilities in states like Massachusetts or Oregon can earn credits by generating power from biomass (including pellets). The inclusion of thermal energy in some state renewable programs (Renewable Heat NY, etc.) has provided grants for biomass heating systems.

- Tax Incentives: A recent boost for pellet heating came with the federal Biomass Stove Tax Credit. As of 2023, under updates in the Inflation Reduction Act, consumers can get a 30% federal tax credit (capped at $2,000) for purchasing and installing qualified wood or pellet stoves and boilershpba.org. This credit runs 2023–2032, encouraging residential and commercial users to switch to high-efficiency biomass heaters. Many states also exempt wood heating fuels from sales tax to make them more affordable.

- Grants and Programs: The USDA and Department of Energy have supported biomass through various programs. For example, the REAP (Rural Energy for America Program) offers grants and loan guarantees to rural businesses for renewable energy systems, which can include pellet heating or combined heat-and-power. The Community Wood Energy Program (part of the 2018 Farm Bill) provides funding for developing wood energy facilities like pellet heating for schools or municipal buildings. These help stimulate demand for pellets and encourage local pellet supply chains.

- Industrial and Power Use: While the U.S. does not yet co-fire pellets in coal plants at the scale of Europe, there have been projects and the EPA’s Clean Power Plan (now superseded) had considered co-firing biomass as a compliance path. Some utilities in the U.S. Southeast have opted to run dedicated biomass power plants or trial co-firing. On the federal level, biomass is generally treated as carbon neutral by policy (e.g. Congress has instructed agencies to recognize the carbon benefits of forest bioenergy), which provides regulatory certainty.

Overall, U.S. policy has been less unified than Europe’s, but the introduction of the pellet stove tax credit marks a significant step to boost the domestic pellet markethpba.org. Combined with state-level actions and the fact that pellets are part of the Biden administration’s renewable energy and forestry initiatives, the U.S. is expected to see steady growth in pellet use domestically, even as it remains a major exporter. Investors in U.S. pellet production also benefit from relatively low-cost fiber and infrastructure geared toward export, which was itself catalyzed by EU policy.

India

India has embraced biomass pellets as a strategy to address two problems: rural air pollution from crop burning and the need to decarbonize coal-heavy power generation. In 2021, the Indian government launched the National Biomass Mission (“SAMARTH”) to promote co-firing of biomass in coal-fired power plants. Under this initiative, the Ministry of Power mandated all coal power plants to use a 5% blend of biomass pellets (by energy) with coal, starting in FY 2024-25, rising to 7% from FY 2025-26pib.gov.in. This is a significant policy – essentially creating a guaranteed demand for biomass pellets (largely from agricultural residues) by the massive coal power sector. India’s aim is both to cut coal consumption and to utilize the ~230 million tons of surplus agricultural residue produced annuallysamarth.powermin.gov.in.

To support this co-firing mandate, multiple incentives and facilitation measures have been put in placepib.gov.in:

- Financial Assistance for Pellet Plants: The Ministry of New and Renewable Energy (MNRE) and the government’s pollution control board (CPCB) rolled out schemes to financially assist in setting up biomass pellet manufacturing unitspib.gov.in. This includes subsidies or soft loans to encourage entrepreneurs (including farmer-producer companies) to invest in pelletization equipment, ensuring supply can meet the new demand.

- Priority Sector Lending: The Reserve Bank of India (RBI) has classified “biomass pellet manufacturing” as an eligible activity under Priority Sector Lendingpib.gov.in. This means banks are encouraged to lend to pellet projects as part of their priority sector obligations, improving access to credit for setting up plants.

- Market and Procurement Facilitation: A market ecosystem is being developed – a procurement portal on the Government e-Marketplace (GeM) specifically for biomass pelletspib.gov.in, standardized long-term fuel supply contracts, and a vendor database have been created to link pellet suppliers with power plantspib.gov.in. The government even provided a model contract template and is conducting awareness programs to connect farmers, aggregators, and plant operatorspib.gov.in.

- Widening Feedstock Base: Policy directives have clarified that a wide range of agro residues can be used – from rice straw, wheat stubble, cotton stalks to mustard husk, coconut shells, etc. – effectively expanding the raw materials eligible for co-firing pelletspib.gov.in. This helps activate supply chains across various agricultural regions (Punjab’s paddy straw, cotton stalks in Maharashtra, etc.).

These efforts are showing results: as of mid-2023, dozens of thermal power stations in India have begun co-firing biomass, with hundreds of thousands of tons of pellets already utilizedpib.gov.inpib.gov.in. India’s policy is notable for directly tying into environmental goals – every ton of pellet used is less crop residue burned in fields and less coal burned in plants. There are also state-level initiatives like in Haryana and Punjab, where state governments purchase pellets or offer extra tariffs to power plants for using biomass. Going forward, India may further increase co-firing percentages and explore dedicated biomass power plants or industrial uses. The policy support in India thus creates a promising market for pellet manufacturers, with the dual appeal of profit and pollution reduction.

China

China, with its vast energy needs and pollution challenges, has also turned an eye towards biomass pellets, but its approach focuses on domestic resource utilization and rural energy. As of 2021, China had built 34 GW of biomass power generation capacity (from virtually zero a decade earlier), with plans for rapid expansionargusmedia.com. The government sees biomass power (including pellet-fueled plants) as a way to provide reliable renewable energy that can complement intermittent sources like solar/windargusmedia.com.

Key policy elements in China include:

- Subsidies for Biomass Power: China’s National Development and Reform Commission (NDRC) announced dedicated subsidies for biomass electricity. In 2021, for example, ¥2.5 billion RMB (~$386 million) was allocated to subsidize biomass power generationargusmedia.com. This subsidy helps make biomass projects financially viable in the face of cheaper coal. Typically, biomass power plants (which often use pellets or briquettes made from agricultural waste) receive a feed-in tariff or subsidy per kWh generated, funded by the central government.

- Co-firing and Coal Replacement: Biomass (including pellets) is promoted as a co-firing fuel in coal power plants and as a coal substitute in industrial boilers and heating systemsargusmedia.com. This aligns with China’s push to reduce coal use for air quality. For instance, many small coal boilers in cities have been converted to burn biomass or natural gas. Some provinces have programs to deploy biomass pellet heating in rural households as a cleaner alternative to raw coal or wood.

- Waste Biomass Emphasis: China’s policies emphasize using agricultural and forestry waste for energy. The government discourages reliance on imported wood pellets – in fact, China placed a ban on importing wood pellets for energy in 2017 to focus on domestic residues (and possibly due to quality concerns)argusmedia.comargusmedia.com. Instead, the country has invested in projects like building dozens of biomass power plants that run on municipal solid waste and agro-residuesargusmedia.com. Cities like Chongqing and Xining have multi-year plans to construct biomass plants to consume local waste and provide electricity and heatargusmedia.com.

- Renewable Energy Targets: While much attention goes to wind and solar, China’s five-year plans include biomass in the renewable mix. By 2030, as part of its carbon peaking efforts, China aims to further expand biomass energy. Biomass (including pellets) is recognized for its steady, dispatchable power which can support grid stability unlike seasonal hydro or daily solar swingsargusmedia.com.

Additionally, China has local incentive programs: some provinces provide investment subsidies for biomass pellet factories, especially if tied to poverty alleviation (turning crop waste into energy in poorer rural areas). There are also pilot counties for clean heating where households get subsidies to install pellet-fueled central heating instead of burning raw coal.

In summary, China’s policy supports biomass pellets chiefly as a tool for rural energy and to reduce coal reliance, backed by subsidies and integration into the power marketargusmedia.comargusmedia.com. Though China’s pellet usage is mostly domestic (it doesn’t import much and isn’t a major exporter yet), the sheer scale of its biomass resources means its policies can quickly ramp up internal demand. For investors, the Chinese market may present opportunities in equipment supply and joint ventures, as the country builds more biomass plants and possibly begins to standardize pellet heating in some regions.

Other Regions

Beyond the big four above, it’s worth noting policies in other pellet-consuming regions:

- Japan and South Korea: These countries have become significant importers of wood pellets for power generation. They implemented feed-in tariffs (FIT) (Japan) and Renewable Portfolio Standards (Korea) that credit electricity from biomass. Japan’s FIT for biomass power has led to large dedicated pellet power plants, with utilities importing pellets from Canada, Vietnam, etc. South Korea’s RPS requires power producers to meet a portion of generation with renewables, and co-firing imported wood pellets has been a convenient way to comply. Both governments are now scrutinizing sustainability of imports but continue to incentivize biomass as part of energy diversification.

- Canada: Canada uses pellets mostly for export, but has programs like the Clean Energy for Rural and Remote Communities initiative, which funds pellet heating projects in indigenous communities and remote towns to displace diesel. Some Canadian provinces (e.g. British Columbia, Quebec) support switching public buildings to pellet heating given their local pellet supply.

- Southeast Asia: Several countries with agricultural sectors (Thailand, Malaysia, Indonesia) are encouraging biomass energy. For instance, Thailand has alternative energy plans that include agricultural waste pellets to fuel power plants, with some subsidies and feed-in premiums. These policies, though smaller in scale, are creating local markets and also export-oriented producers.

Across the board, government actions are critical in this industry. By putting a price on carbon, offering credits for renewables, or directly funding biomass projects, policymakers reduce the risk and improve the ROI for pellet projects. Stakeholders in the pellet industry (investors, manufacturers, farmer co-ops) should stay attuned to policy changes, as these can rapidly open up new markets or, conversely, tighten sustainability requirements. The general trajectory, however, is that biomass pellets are seen as a valuable component in meeting climate goals, and thus enjoy a favorable policy environment in many jurisdictions.

Use Cases of Biomass Pellets: Heating, Power Generation, and Industrial Fuel

Biomass pellets are a versatile fuel with a range of applications across residential, commercial, and industrial sectors. Their uniform form and high energy density make them suitable in systems traditionally designed for solid fuels, with minimal modifications. Here are the primary use cases:

Heating (Residential & Commercial)

One of the most widespread uses of pellets is for space heating in homes and buildings. Pellet stoves and pellet boilers have become popular in Europe and North America as a cleaner, automated alternative to traditional wood stoves or oil furnaces. Homeowners can use bagged wood pellets in a stove appliance that automatically feeds the pellets into the burn chamber, providing steady heat with minimal manual effort. These stoves often have efficiency >85% and very low emissions, making them eco-friendly for home heatingkumarmetal.comkumarmetal.com.

For larger scale heating, pellet boilers can provide central heating and hot water for schools, apartment complexes, hospitals, or district heating networks. For example, many schools in Austria and Sweden have converted to pellet-fired boiler systems. Pellets’ consistent quality and flow allow these boilers to be automated much like gas boilers. In rural areas without gas service, pellets are an economical and carbon-neutral option to replace fuel oil, and they are relatively price-stable compared to fossil fuelskumarmetal.com. Commercial buildings and greenhouses also use pellet boilers.

Pellet heating benefits include: cleaner combustion (very little smoke or creosote), convenience (deliveries can be automated by tanker truck blowing pellets into a storage silo, akin to oil delivery), and renewable sourcing. Many governments encourage pellet heating with incentives (as discussed). As a niche example, pellets are even used in some pellet furnaces for grain dryers or poultry farm heaters, providing a farm-scale renewable heating solution.

Power Generation (Electricity Production)

Biomass pellets are increasingly used in power generation, either by co-firing in coal power plants or in dedicated biomass power stations. Co-firing involves mixing a percentage of pellets with coal and burning them together in existing coal-fired boilers. This approach is attractive because it can significantly reduce the CO₂ emissions of power plants without major changes to infrastructure. For instance, in the UK’s Drax Power Station (a former coal giant now largely converted), wood pellets imported from North America are burned to generate renewable electricity at utility scale. Many coal plants can typically co-fire up to 5–10% biomass with minor modifications (or even more with moderate retrofits) – hence policies in Europe and Asia have pushed this as a quick decarbonization measurepib.gov.inargusmedia.com. As noted, India’s coal plants are mandated to co-fire 5–7% agro-pellets, a prime example of this use casepib.gov.in. Co-firing pellets can also reduce emissions of sulfur and other pollutants in coal plants.

Dedicated biomass power plants usually use circulating fluidized bed boilers or similar technology to efficiently burn pellets (or other biomass) alone. Countries like Japan, South Korea, the Netherlands, and the UK have several such plants, often supported by renewable energy incentives. These plants sometimes consume millions of tons of pellets annually, feeding a steady baseload power into the grid. Pellets are favored because their uniform size and predictable combustion make it easier to feed and control the boiler compared to raw biomass (which might vary in moisture or size). Pellets also have lower transportation costs, which is crucial if a plant relies on imported fuel.

Pellets used for power generation are predominantly wood pellets or palm kernel shell pellets in the international trade, due to their high energy content and low ash. Using pellets in power generation is effectively a way to store solar energy (via biomass growth) and release it on-demand for electricity, providing dispatchable renewable power. This is particularly valued in grids that have high solar/wind penetration and need a stable renewable source to balance intermittency. It’s worth noting that some advanced power systems use CHP (Combined Heat and Power), where a pellet-fired boiler generates electricity and the waste heat is captured for heating (e.g. district heating networks). This maximizes energy efficiency – a pellet CHP plant can achieve 70–80% total energy utilization by outputting both power and useful heatkumarmetal.com.

Industrial Fuel

Beyond home heating and grid power, biomass pellets serve as an industrial fuel for various processes:

- Industrial Boilers and Steam Generation: Many industries require steam or heat for processes (food processing, textiles, paper, chemicals, etc.). Pellets can replace coal, gas, or oil in industrial boilers to produce steam for process heat or for small-scale power generation on-site. For example, breweries, dairies, and manufacturers have installed pellet-fired boilers to reduce fossil fuel use. Pellets have been used in brick kilns and lime kilns as well, partially substituting coal while reducing emissions.

- Cement and Lime Industry: Some cement plants have trialed co-firing biomass pellets or briquettes in their kilns to cut CO₂ emissions from the very carbon-intensive calcination process. While not extremely common yet (due to the need for consistent high temperatures), it is an area of development.

- Combined Heat and Power for Industry: As mentioned, CHP units burning pellets are used in sawmills (to power their operations using their own sawdust pellets), in agro-processing (sugar mills could pelletize bagasse for off-season use), and other integrated setups. An industrial CHP using pellets can provide a factory with electricity and process steam in a self-contained renewable systemkumarmetal.com.

- Pellet Gasification: In some cases, pellets are used as feedstock for gasification units that generate syngas for industrial use or even for fueling internal combustion engines/generators. Pellets are ideal for gasification because their low moisture and uniform size allow more controlled gasifier operation. This has been explored in projects for producing hydrogen or chemicals from biomass, though it’s still an emerging application.

- District Heating Plants: On the border of industrial use, pellet-fired district heating plants (common in Scandinavia and expanding elsewhere) supply hot water via pipelines to whole communities. These plants are essentially medium-sized “industrial” pellet boilers providing heating as a service. They demonstrate how pellets can fuel not just individual devices but scaled-up systems.

In all these industrial uses, pellets offer the benefit of drop-in convenience – they can often be used in equipment designed for coal or wood chips with minimal changes, especially if the system can handle the ash difference. Industries also appreciate that pellets have predictable pricing under contracts, allowing for fuel cost planning, and help meet corporate sustainability goals by cutting fossil fuel use.

Niche and Emerging Uses

It’s also worth noting a few niche uses of pellets:

- Cooking Fuel: In some developing regions and eco-conscious communities, pellet-based cookstoves or micro-gasifier stoves are used for cookingkumarmetal.com. Pellets provide a cleaner cooking experience than traditional wood or dung fires, reducing indoor air pollution. Efforts by organizations (e.g. in Africa and South Asia) have introduced pellet stoves for clean cooking, sometimes coupling them with local pellet micro-enterprises (using agro-waste). This remains a small segment but one with social importance.

- Pellet BBQs and Grilling: There’s a growing trend (especially in North America) of pellet grills for outdoor cooking. These appliances use wood pellets (often flavored wood varieties) to provide controlled heat and smoke for barbecuing. It’s a premium market where pellets are used for their flavor as well as convenience (thermostat-controlled grilling).

- Animal Bedding and Absorbents: Interestingly, some pellets (made from miscanthus or softwood) are used as animal bedding or litter. While not burned, this still is a value-add use of pelletized biomass. After use, the soiled pellets can be composted or used in anaerobic digesters, thus still contributing to energy or soil enrichment.

In summary, biomass pellets have proven their utility across a broad spectrum – from a single home’s stove to massive power stations. This flexibility is a major selling point to investors and stakeholders: a pellet plant’s output can potentially serve multiple markets, providing resilience. For example, a plant could sell premium pellets to households and lower-grade pellets to industries, ensuring nothing goes to waste. As technology advances (like more coal plants adapting to pellets, or more efficient small-scale pellet appliances), we can expect the range of pellet use cases to further expand, cementing their role in the global energy mix.

Conclusion and Outlook

Biomass pellets have emerged as a cornerstone of the renewable energy landscape, bridging the gap between sustainable resource management and modern energy needs. From the global market perspective, we see a robust growth trajectory – tens of millions of tons consumed annually and rising – as nations strive to meet climate goals and secure stable energy supplyren21.netpellet.org. Investors and energy professionals are increasingly viewing pellets not as a niche but as a mainstream commodity, complete with international trade, futures markets, and technological innovation.

This comprehensive overview highlighted how biomass pellets transform low-value residues into high-value fuel: woody and agricultural wastes are compressed into uniform energy-rich pellets that can be efficiently stored and transported. We detailed the feedstock options (wood, crop residues, energy crops, etc.) and their differing technical specs like calorific value and ash content, which inform their best uses. The production process – though capital-intensive – is well-established, and continuous improvements in pellet mill technology and process integration (like using waste heat for drying) are driving costs down and yields up. A breakdown of costs shows that while initial investment is significant, operational costs can be managed to create profitable operations, especially where policies or markets provide supportextension.psu.edubestpelletplant.com.

Crucially, biomass pellets deliver significant environmental benefits. They directly displace fossil fuels, cutting net carbon emissions by roughly 80% compared to coalalliedmarketresearch.com, and help solve local pollution issues (whether it’s smog from burning crop stubble or sulfur emissions from coal plants). Pellets embody the principles of the circular economy – using renewable biological cycles instead of one-way extraction of fossil carbonkumarmetal.com. By incentivizing better land and waste management, they contribute to sustainable development outcomes for rural communities and industries alike.

Government incentives worldwide underscore the strategic importance of pellets. The EU’s renewable energy directives, U.S. tax credits for pellet heating, India’s co-firing mandate, and China’s biomass subsidies all create a tailwind for pellet demandpib.gov.inargusmedia.com. These policies reduce investment risk and often directly improve project economics (through subsidies or carbon pricing that favors biomass). It’s clear that aligning a pellet project with current policy incentives – such as targeting co-firing markets in Asia or district heating conversions in Europe – can significantly enhance its success.

Looking ahead, several trends are worth watching in the biomass pellet domain:

- Innovation in Feedstocks and Processes: We may see more use of torrefied pellets (“black pellets”) for power generation, as they offer logistical advantages. Research continues into pelletizing a wider range of feedstocks – from invasive weeds to algae residues – potentially expanding resource availability. Improvements in binders or pre-treatments could enable high-ash agro-pellets to burn as cleanly as wood pellets, opening new markets.

- Scaling and Efficiency: Pellet production facilities are scaling up. We will likely see more mega-plants (over 500,000 ton/year capacity) especially in regions with surplus biomass (Southeast U.S., Russia, Southeast Asia) to supply global markets. Automation and energy integration (CHP at pellet mills, etc.) will improve margins and lower the carbon footprint of production itself.

- Sustainability and Certification: As the industry grows, so does scrutiny. Expect even greater emphasis on certifications like ENplus, SBP (Sustainable Biomass Program), and others ensuring that pellets are sustainably produced. This is both a challenge and an opportunity – companies that demonstrate strong sustainability credentials might fetch premium prices or secure long-term contracts with utilities concerned about ESG (Environmental, Social, Governance) criteria.

- Market Diversification: While power and heat remain primary uses, new markets could emerge. For example, biorefineries might use pellets as feedstock for biofuels or biochemicals via gasification or pyrolysis routes. Or, pellets could serve in energy-intensive industries seeking green alternatives (like steelmaking processes exploring biomass-based reducing agents). The versatility of pellets means they could slot into various industrial ecosystems beyond direct combustion.

- Geopolitics and Security: Energy security concerns can boost pellet adoption. The Europe-Russia energy crisis of 2022 led to record spot prices for pellets as countries scrambled for heating fuel. Governments may thus support domestic pellet supply chains as part of energy security strategies, which could accelerate projects in areas that traditionally imported fuels.

In conclusion, biomass pellets present a compelling synergy of economic opportunity and environmental stewardship. For investors and entrepreneurs, pellet projects can tap into the growing green energy investment wave, capitalizing on abundant raw materials and technology maturation. For manufacturers and farmer-producer companies, pellets offer a value-add path for agricultural or forestry byproducts, integrating them into a profitable value chain. And for energy sector professionals and policymakers, pellets are a proven tool to decarbonize and diversify energy supply, from rural villages to metropolitan power grids.

The trajectory is clear: as the world transitions to cleaner energy, biomass pellets will be a key piece of the puzzle – a renewable fuel that packs the power of biomass into a convenient pellet, fueling a greener future one pellet at a time. By continuing to innovate and adhere to sustainable practices, the pellet industry is poised for sustained growth, delivering heat, power, and climate solutions on a global scale.

Sources:

- REN21 – Renewables Global Status Report 2023 (Bioenergy Market)ren21.netpellet.org

- Allied Market Research – Biomass Pellets Market Forecast 2024–2033alliedmarketresearch.comalliedmarketresearch.com

- Kumar Metal – Biomass Pelletisation Guide (2024)kumarmetal.comkumarmetal.comkumarmetal.com

- Servoday Biomass Blog – Best Types of Biomass for Pellets (2025)servoday.inservoday.in

- Penn State Extension – Manufacturing Fuel Pellets from Biomassextension.psu.eduextension.psu.edu

- Penn State Extension – Pellet Production Cost and Energyextension.psu.eduextension.psu.edu

- BestPelletPlant.com – Cost Analysis of Wood Pellet Plantbestpelletplant.combestpelletplant.com

- PIB India – Press Release on Biomass Co-firing Policy (Aug 2023)pib.gov.inpib.gov.in

- Argus Media – China Biomass Power Generation Subsidy (2021)argusmedia.comargusmedia.com

- Pellet.org – European Pellet Conference Report 2024 (WPAC)pellet.orgfern.org

- Pellet Fuels Institute – Residential Pellet Fuel Standardskumarmetal.com

- Biomass Magazine – Carbon Savings of Pellets vs Fossil Fuelsalliedmarketresearch.com

- Energy Star / IRS – US Biomass Stove 30% Tax Credit Detailshpba.org